Introduction

This Article tells about the importance of enforcement of Insolvency and Bankruptcy code,2016. As erstwhile regime in respect of the revival of companies were not so effective for the companies or organizations, LLP and Partnership firm. The enforcement of this code is to protect the interest of the corporate debtor, creditors (operational/financial) of the company including the stakeholders of the Company. That the main aim of this code is to consolidate and amend all existing insolvency laws in India and revive the company organizations, LLP, Partnership firm in a time bound manner so, that the interest of any party should not be effected in any Manner. Also to get necessary relief to the creditors (operational/financial) and consequently increase the credit supply in the economy. This Article tells also tells about the difference between the Insolvency and Bankruptcy why it is important for the corporate entities and also the detailed procedure to be followed after the admission of the application before the Adjudicating Authority.

Insolvency cases have risen exponentially in India over the past decade with over 2,700 companies forced into bankruptcy proceedings in 2018-19 alone. This Article explains the significance of the Insolvency and Bankruptcy Code, 2016 (IBC) in addressing pitfalls in previous resolution mechanisms. The Code aims to provide credible revival pathways for distressed companies and partnerships while balancing stakeholder interests. We outline key facets of this legislation hailed for ushering transparency and efficiency into insolvency proceedings.

Background of IBC,2016

The Insolvency and Bankruptcy Code (IBC) is the bankruptcy law in India which seeks to consolidate the existing framework by creating a single law for insolvency and bankruptcy. Here are some key details about the IBC:

- It was passed in May 2016 by the Parliament of India and came into effect in December 2016. So the IBC was established in 2016.

- The IBC consolidated the existing framework by repealing the Presidency Towns Insolvency Act, 1909 and Provincial Insolvency Act, 1920.

- The code applies to Companies, limited liability partnerships, partnership firms and individuals.

- It outlines separate insolvency resolution processes for corporates, partnerships & individuals. It also has provisions for cross-border insolvency.

- The IBC provides for a time-bound process to resolve insolvencies- Fast Track process within 90 days and Insolvency Resolution process within 180 days (extendable by 90 more days).

- It established the Insolvency and Bankruptcy Board of India (IBBI) to regulate the insolvency process, insolvency professionals and information utilities.

Importance and purpose.

- The IBC sought to consolidate the existing laws relating to insolvency into a single code. This provides clarity and coherence compared to earlier fragmented laws.

- Another significant objective was to established strict, time-bound processes to resolve insolvencies- either through a resolution plan or ultimate liquidation- rather than allowing prolonged delays.

- The IBC code aims to maximize value of assets by keeping distressed companies operating as going concerns during insolvency proceedings. This enables higher recoveries.

- The Code seeks to boost entrepreneurship and risk-appetite by lowering business exit barriers. The 270-day timeline for completion of corporate insolvency resolution process introduces predictability.

- The World Bank has recognized India’s substantial improvement in resolving insolvency, reflected in an ascent to 52nd rank in 2023 on the Ease of Doing Business index from 136th rank in 2015. The Code has reinforced debt recovery mechanisms.

Understanding terms of Insolvency and Bankruptcy:-

Insolvency is a situation when an Individual, Company, Partnership, Hindu Undivided Family, Trust, LLP (limited liability Partnership) or any other entity established under this Statute incapable to pay back the creditors since the responsibilities/liabilities (loans) and advances have exceeded the assets, such a state is known as insolvency.

Whereas Bankruptcy proceedings are started when an Individual, Company, Partnership, Hindu Undivided Family, Trust, LLP (limited liability Partnership) or any other entity established under this Statute unable to repay the financial obligations because to insolvency, or a shortage of assets. The debtor or even creditors (operational/ Financial) may submit the application. It is the court’s acknowledgement of the individual’s incapacity to repay the assets and the requirement for government intervention. Reorganizing assets for the purpose of repayment or liquidating assets to satisfy creditors are two possible outcomes of bankruptcy.

Person entitled to initiate the Corporate Insolvency Resolution Process.

The below persons has entitled to initiate the Corporate Insolvency process if any corporate Debtor commits a default as defined under section 3 clause 12 of the Insolvency and Bankruptcy Code,2016.The Financial Creditor, Operational Creditor and Corporate Applicant initiate corporate insolvency resolution process in respect of such corporate debtor in the manner as provided under this Code.

That the Financial creditor can file an application under section 7 of this code and imitate the CIRP proceeding against the corporate debtor, if the corporate debtor commits the default also the Operational Creditor can file an application under section 9 of this code and initiate the CIRP proceeding against the Corporate Debtor. Furthermore, corporate Applicant can file an application before the Adjudicating Authority under section 13 of this code and initiate the CIRP proceeding against the corporate debtor.

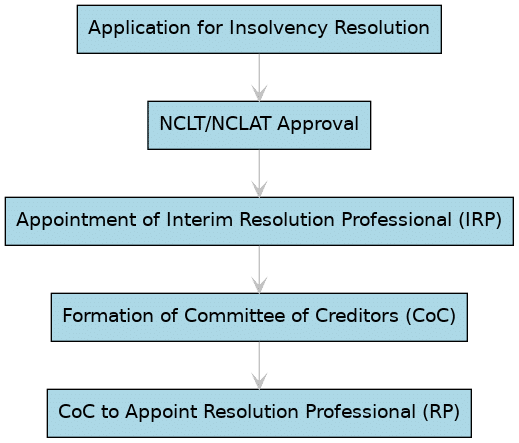

On admission of application by National Company Law Tribunal, an interim insolvency professional (IP) is appointed. The committee of creditors has the authority to replace the interim IP and confirm the appointment of IP. They exercise oversight across CIRP. The IP takes over management and powers of board of directors stand suspended.

Consequences of initiation of CIRP

- There are generally two consequences that can follow the initiation of CIRP, namely:

- Revival of the corporate debtor, or

- Liquidation

- Revival of the corporate debtor:

The main objective of CIRP is to resolve insolvency through a credible revival plan for the corporate debtor. The insolvency professional prepares an information memorandum to invite prospective resolution applicants to submit resolution plans. The committee of creditors approves a plan that restructures debt and infuses funds to continue operations. This allows the debtor to restart normal business operations under a new repayment plan.

- Liquidation:

If the advisor does not receive resolution plans or the committee of creditors rejects plans received, the corporate debtor goes into liquidation. A liquidator is appointed to sell assets and distribute proceeds to creditors per the priority set out in the code. This leads to closing of the company.

Regulatory and Governing Authorities under this Code

The key authorities governing insolvency resolution and bankruptcy proceedings under IBC are:

- Insolvency and Bankruptcy Board of India (IBBI) – regulates insolvency professionals, insolvency professional agencies and information utilities

- National Company Law Tribunal (NCLT) – adjudicating authority that admits insolvency cases and approves/rejects resolution plans

- Insolvency Professionals (IP) – appointed by committee of creditors to manage insolvency resolution process

- Information Utilities – collect, collate and disseminate financial information related to debtors. Information Utilities autorhized by IBBI securely store financial data like borrowings, default history and security interests of firms. This information can help ascertain onset of distress earlier and verify claims expeditiously during insolvency proceedings. Utilities like NeSL provide accessible platforms for stakeholders to record debt information minimizing disputes.

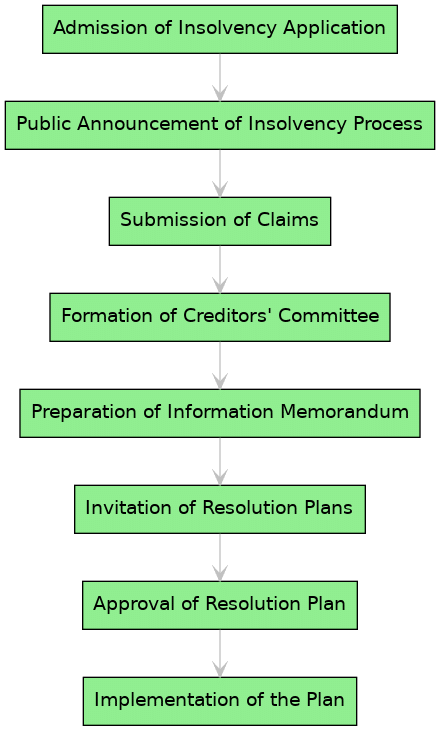

Procedure to be followed by the Insolvency Professionals

The insolvency professional (IP) appointed by the adjudicating authority has to follow a detailed procedure consisting of multiple stages simultaneously to effectively resolve the insolvency of the corporate debtor.

- Public Announcement and Claims Collation

- IP issues public announcement inviting claims from creditors within 21 days

- Verifies claims received by requisite documentation and evidence

- Categorizes claims as financial, operational, workmen, employees etc.

- Maintains listing of claims and claimants as per categories

- Seeks clarifications from claimants wherever required

- Committee of Creditors Constitution

- Based on verified claims, divides creditors into classes and identifies financial creditors

- Determines voting shares of members based on proportion of debt owed

- Constitutes the committee of creditors (CoC) with only financial creditors

- The CoC then appoints the Authorized Representative to coordinate between IP and CoC

- Management and Governance

- IP takes custody of assets and company properties along with books of accounts

- Suspends powers of board and management which transfers to IP

- IP manages operations, renegotiates contracts, raises interim finance as going concern

- No management decisions can be taken without approval of CoC

- IP has right to attend CoC meetings to inform progress

- Information Memorandum

- IP prepares exhaustive Information Memorandum covering all information required for resolution planning

- Includes capital structure, assets, liabilities, sector outlook, last 5 year finances etc.

- This memorandum is provided to prospective resolution applicants for due diligence

- Resolution Plan Submission and Approval

- IP invites prospective applicants to submit resolution plans within set timeframe through an RFRP

- Received plans are evaluated on feasibility, viability and fair treatment of creditors

- The CoC examines each plan and approves a plan by 66%+ majority voting share

- The adjudicating authority provides final approval to the plan

As we can see, the IP manages the entire process over 180-270 days (extendable upto 330 days if legally contested) right from collating claims to inviting and processing applications to secure optimal plan.

The IP is also required to regularly inform the NCLT on the progress.

Sequence of Distribution of the Assets.

The proceeds from sale of assets during liquidation is distributed in order set out in section 53:

- CIRP and liquidation costs

- Workmen’s dues for past 24 months

- Secured creditors

- Employee wages for past 12 months

- Unsecured financial creditors

- Government dues

- Any remaining debt

- Preference shareholders

- Equity shareholders

Landmark judgements

Some key judicial pronouncements have set important precedents regarding legal interpretation as well as validating certain provisions of the Insolvency and Bankruptcy Code:

- Swiss Ribbons vs Union of India (2019): Supreme Court upheld the constitutional validity of the IBC and ruled that the 270-day outer limit for resolution process does not violate right to equality and is reasonable.

- Committee of Creditors of Essar Steel India Limited v Satish Kumar Gupta (2020): Upheld supremacy of the Committee of Creditors in deciding resolution plans under section 30 and 31 of the code.

- Anuj Jain vs Axis Bank (2020): Supreme Court affirmed NCLT and NCLAT decision rejecting application of suspension of CIRP proceedings due to COVID-19 pandemic. Upheld sanctity of timelines under the code.

- Jaypee Infratech Limited v Axis Bank (2021): Supreme Court ruling stating that time spent in legal challenges shall not count in the 330 days’ time limit for resolution process under the CIRP Regulations.

These landmark rulings have reinforced the Code’s objectives, validated time-bound processes and enhanced the capability of committees of creditors. By upholding key provisions, the judgments have cemented IBC’s status as a game changing economic legislation.

Conclusion

The Insolvency and Bankruptcy Code provides a structured and time-bound process for dealing with debt defaults and insolvency of companies and partnerships in India. It aims to promote entrepreneurship and increase availability of credit by lowering non-performance assets. With dedicated insolvency professionals, information utilities and adjudicating authorities now in place, the code seeks to effectively resolve stressed assets while balancing interests of all stakeholders. The efficacy of the resolution frameworks in providing second lifelines to otherwise viable businesses in a time sensitive way is central to realizing the economic objectives behind the code.

Topics Covered: IBC, Insolvency, CIRP, Insolvency Professional, National Company Law Tribunal (NCLT), Corporate Debtor, Financial Creditor, Operational Creditor, Committee of Creditors, Adjudicating Authority, Liquidation, Resolution Plan, Insolvency and Bankruptcy Board of India (IBBI), Information Utilities, Public Announcement, Claims Collation, Management and Governance, Revival, Insolvency Resolution, Bankruptcy Proceedings, Default, Creditors’ Rights, Legal Framework, Economic Impact, Ease of Doing Business, Cross-Border Insolvency, Moratorium, Non-Performing Assets (NPAs), Pre-Packaged Insolvency Resolution Process, Authorized Representative, Employee Dues, Legal Reforms, Judicial Pronouncements, Asset Distribution, Landmark Judgements, Swiss Ribbons vs Union of India, Committee of Creditors of Essar Steel India Limited v Satish Kumar Gupta, Anuj Jain vs Axis Bank, Jaypee Infratech Limited v Axis Bank, Insolvency Cases, Insolvency Code Enforcement, Legal Mechanisms, Stakeholder Interests, Transparency in Insolvency Proceedings, Business Exit Barriers, Entrepreneurship Promotion, Credit Supply Increase, Debt Recovery Mechanisms, Financial Obligations, Corporate Insolvency Resolution Process Initiation, Interim Insolvency Professional, Resolution Applicants, Legal Interpretation, Corporate Insolvency, Business Law, Financial Law.

FAQs about Corporate Insolvency Resolution Process (CIRP) under the Insolvency and Bankruptcy Code (IBC), 2016:

- What is the Insolvency and Bankruptcy Code (IBC), 2016?

- The IBC, 2016, is a bankruptcy law in India aiming to consolidate all existing insolvency laws into a single code, facilitating a timely resolution process for distressed companies and individuals.

- Who can initiate the CIRP process?

- The CIRP process can be initiated by financial creditors, operational creditors, or the corporate debtor itself upon committing a default.

- What is the difference between insolvency and bankruptcy?

- Insolvency is a state where an entity cannot pay its debts, while bankruptcy is a legal declaration of one’s inability to pay off debts, leading to a resolution process.

- How long does the CIRP process take?

- The CIRP process is designed to be completed within 180 days, extendable by 90 days, making a total of 270 days.

- What happens during the CIRP process?

- During CIRP, an interim insolvency professional takes over the management of the debtor, creditors form a committee, and together, they aim to devise a resolution plan to revive the debtor or liquidate its assets.

- What is the role of the National Company Law Tribunal (NCLT) in CIRP?

- The NCLT acts as the adjudicating authority, overseeing the entire CIRP, including the approval or rejection of the resolution plan.

- Can the CIRP lead to the liquidation of the corporate debtor?

- Yes, if a resolution plan is not approved within the stipulated time, the corporate debtor may be pushed into liquidation.

- What is a resolution plan?

- A resolution plan outlines the strategies for the financial restructuring of the debtor to restore its viability and repay creditors.

- Who are financial and operational creditors?

- Financial creditors have lent money against a promise of interest, while operational creditors are entities to whom debts are owed for goods or services provided to the debtor.

- What does the term ‘default’ mean in the context of IBC?

- A default refers to the non-payment of a debt when it becomes due and payable by the debtor, triggering the CIRP process.

- Can a resolution plan change the management of the corporate debtor?

- Yes, a resolution plan can propose changes in the management of the debtor to ensure its successful revival.

- What is the Insolvency and Bankruptcy Board of India (IBBI)?

- The IBBI is a regulatory body established to oversee the insolvency proceedings and entities like insolvency professionals and information utilities under the IBC.

- How does CIRP benefit the Indian economy?

- By resolving insolvencies quickly, CIRP aims to maximize asset value, promote entrepreneurship, and enhance creditor recoveries, positively impacting the economy.

- What are information utilities?

- Information utilities are repositories that collect, store, and disseminate financial information about debtors to facilitate the insolvency process.

- How is the committee of creditors formed?

- The committee of creditors is formed by collating all financial creditors of the corporate debtor post the public announcement of CIRP.

- What rights do operational creditors have in the CIRP?

- Operational creditors may attend the committee of creditors’ meetings but usually do not have voting rights unless they are significant in value.

- What happens if the resolution plan is rejected?

- If the resolution plan is rejected, the corporate debtor may be liquidated to repay the debts to the extent possible.

- Can a debtor voluntarily enter CIRP?

- Yes, a corporate debtor can voluntarily initiate CIRP by filing an application with the NCLT.

- What impact has IBC had on the ease of doing business in India?

- The IBC has significantly improved India’s Ease of Doing Business ranking by streamlining the resolution of insolvencies.

- How are assets distributed in liquidation under IBC?

- Assets are distributed in a specific order: covering insolvency resolution costs, worker dues, secured creditors, unsecured creditors, government dues, and finally equity shareholders.

- What landmark judgments have shaped the implementation of IBC?

- Notable judgments include Swiss Ribbons vs Union of India, which upheld IBC’s constitutional validity, and Committee of Creditors of Essar Steel India Limited vs Satish Kumar Gupta, which emphasized the committee of creditors’ supremacy.

- How does CIRP address cross-border insolvency?

- While the IBC 2016 initially lacked specific provisions for cross-border insolvency, recent amendments and the Insolvency Law Committee’s recommendations are paving the way for more coherent cross-border insolvency processes. This aims to address insolvency cases involving debtors with assets or creditors in multiple countries, aligning India with international practices like the UNCITRAL Model Law on Cross-Border Insolvency.

- What are the qualifications for becoming an Insolvency Professional (IP)?

- Insolvency professionals must be registered and certified by the Insolvency and Bankruptcy Board of India (IBBI). They typically have backgrounds in finance, law, or management, and must pass a qualification exam administered by the IBBI.

- Can creditors appeal against the decisions made in the CIRP process?

- Yes, creditors have the right to appeal decisions made during the CIRP process, including the approval or rejection of resolution plans, at the National Company Law Appellate Tribunal (NCLAT) and subsequently at the Supreme Court of India if required.

- How has the IBC 2016 impacted non-performing assets (NPAs) in India?

- The IBC 2016 has significantly impacted the reduction of NPAs by enabling the resolution of large default cases, thereby improving the financial health of banks and financial institutions.

- How does the IBC impact small creditors and startups?

- The IBC provides a mechanism for small creditors and startups to recover debts efficiently, potentially preventing their own financial distress by ensuring faster resolution processes.

- What is a moratorium in the context of CIRP, and what does it entail?

- A moratorium under IBC is a period during which legal actions cannot be pursued against the debtor, aimed at allowing the company the breathing space to formulate a resolution plan without external pressures.

- Can creditors recover their full dues under CIRP?

- Recovery depends on the resolution plan and the financial health of the corporate debtor. In some cases, creditors may have to accept a haircut or a reduction in the claim amounts to facilitate the resolution process.

- What role does the Authorized Representative play in CIRP?

- In cases involving a large number of operational creditors, an Authorized Representative is appointed to represent the interests of these creditors in the committee of creditors, ensuring their perspectives are considered.

- How does the resolution process affect employees of the corporate debtor?

- Employees’ dues are prioritized under the IBC, with wages and unpaid dues being settled from the proceeds of the resolution process, safeguarding their interests to some extent.

- What is a pre-packaged insolvency resolution process?

- A pre-packaged insolvency resolution process is a blend of formal and informal mechanisms that allows the debtor and creditors to agree on a resolution plan before initiating formal insolvency proceedings, aimed at speeding up the resolution process.

- How does IBC address the issue of non-performing assets (NPAs) in the banking sector?

- By facilitating the efficient resolution of distressed assets, the IBC aims to reduce the burden of NPAs on the banking sector, thereby improving the health and liquidity of banks.

- What is the success rate of CIRP under IBC?

- The success rate varies, with several cases resulting in successful resolution plans that revive the corporate debtor, while others may end in liquidation. The overall impact, however, has been positive in terms of resolution timelines and recovery rates compared to pre-IBC mechanisms.

Also Read:

Writ Petition – Types, Important Judgements, How and When to File | Lawyer for Writ Petition

Fundamental Rights and Duties in Indian Constitution: Explained in Detail

In-Depth Analysis of Article 14 of the Indian Constitution